All-In-One Scriptless Test Automation Solution!

All-In-One Scriptless Test Automation Solution!

Top 5 insurance industry challenges solved by scriptless testing automation

Scriptless automation tools are playing a key role in accelerating software testing cycles, increasing test coverage, and optimizing resource costs in insurance IT teams. By helping save valuable resource time, it is helping insurance companies to launch new game-changing software applications that are reliable and stable. By achieving faster time-to-market and fulfilling customer needs, it is an indispensable tool for insurance industry CTOs and tech teams.

Scriptless test automation solutions are the way forward for them to validate and launch new services quickly. These services require stable and reliable customer-facing features along with flexible and accurate backend process-driven apps.

With our end-to-end application modernization, data migration, and testing services, we are assisting insurance organizations to develop, test, and release robust insurance applications. By deploying our scriptless test automation tool IntelliSWAUT, we are speeding-up essential testing procedures. Our insurance modernization assurance can automate functional and non-functional tests, load performance tests, and mobile tests among several others that are essential for any new product or feature to be used.

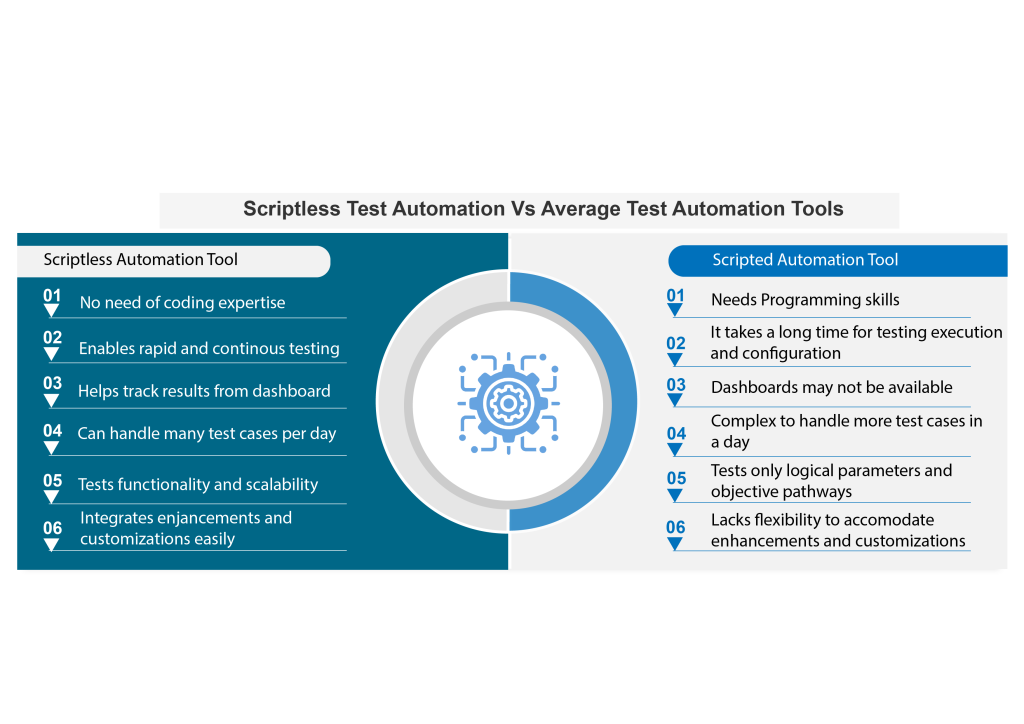

The right scriptless testing tool will help address coding challenges, script maintenance, and results execution frequencies as demanded by the business.

When using scriptless test automation, testers need not possess deep knowledge and expertise of writing codes. It can help even business users to automate test cases without being concerned about writing the code. As the AI-driven tool can write the code for testing purposes, the software development lifecycle can significantly speed up the release of any new feature the business wants to introduce. With reusability of code, faster test development, easy maintenance, and reduced dependence on technical resources make IntelliSWAUT a valuable asset for new software product owners in the insurance domain.

Sun Technologies is making scriptless testing technologies accessible to insurance tech teams in a cost-optimized manner. By investing in AI to enhance scriptless capabilities we are further accelerating the release of quality applications for insurance customers while helping the industry adapt to dynamic market demands.

By using a Scriptless testing framework, testing teams can minimize scripting efforts in real-time testing scenarios. The development team implements tests using auto-scripting tools that mimic the coding experts’ inputs for all scenarios. Using the auto-machine tool, testers can directly point to the process of the framework instead of writing manual code, while these frameworks can convert segue into test cases. This way, test cases can be executed continuously, and the pace of releasing quality products can be scaled up significantly.

Challenge:

Robust security testing can help prevent Ransomware attacks on insurance customers and applications. Without efficient security testing mechanisms, insurance companies will continue to experience data theft and depreciating customer confidence.

Solution:

With security testing, you can identify the risks in your application’s design and architecture and prevent attacks before it happens. Our expertise in enhancing security testing in the insurance domain can help protect your applications and customers from cyber threats. Our domain testing professionals are adept at running network-based Security Vulnerability and Penetration Testing to verify that your consumers’ data is never leaked when performing any online activity.

Challenge:

It is common for insurance app modules to use a common database that has overlaps in several different process modules. It is also extremely challenging to locate any piece of information or object in the specific data and make multiple calls from different data tables.

Solutions:

We can deploy a Scriptless test automation tool which will help perform visual test design in conjunction with data-driven testing, and built-in database validation. We can simplify testing and ensure accuracy in complex database scenarios. Our data-centric testing capabilities are helping move and migrate highly confidential data into new architectures like Phoenix from legacy programming languages such as PowerBuilder and COBOL.

Challenge:

Customization is all about releasing new features in apps, introducing new plans, helping customers navigate in a new way, and/or introducing a new experience. Constant realignment of existing apps and databases poses a massive challenge in maintaining functional efficiency.

Solution:

Sun Technologies’ IntelliSWAUT tool suite provides a balance between ease of use and more customization capabilities. We can help leverage a hybrid approach where scriptless actions can be combined with custom code to handle complex scenarios and enable insurers to undertake testing more quickly while meeting new development and business objectives. It includes best test practices, metrics, and mythologies throughout the testing organization.

Challenge:

CI/CD requires a well-orchestrated infrastructure that supports continuous integration, automated testing, and deployment. Setting up and maintaining the necessary infrastructure components, such as building servers, testing environments, and deployment pipelines is challenging and time-consuming.

Solution:

Our development and operations teams can help integrate scriptless testing with the aim of embedding CI/CD process with a well-match infrastructure alignment. We can help automate test execution while suggesting the most cost-optimized infrastructure alignment that enables continuous integration. Using an industry-tested tool like IntelliSWAUT, you can support DevOps teams and make continuous integration a smooth and easy process.

Challenge:

Using legacy IT systems along with their architecture to generate quotes poses a massive challenge for the insurance industry. Insurance companies need QA testers who have deep knowledge of the insurance domain and understand its complex business rules.

Solution:

With our understanding of the end-to-end policy life cycle, we can help leverage automation testing to enhance the quote generation experience. We can test the efficacy of any newly integrated front-end architecture by rapidly pacing-up testing timelines. Our scriptless test automation tool and frameworks for the insurance industry minimize testing cycle time, enhance productivity, and raise quality. It gives insurance companies the ability to improve predictability and mitigate possible miscalculations in advance.

Product owners and application development teams often require programming knowledge to do their job. That’s when they start chasing DevOps and backend engineers to create new test cases and environments. With our scriptless test platform, they can now rapidly increase test cover in an independent manner without relying on technical or programming resources.

The constant pressure to release new features can rush the whole testing process and result in a loss of quality. Scriptless automated testing makes it possible to speed up regression testing and bring down the time taken to integrate new features. We bring you the most efficient way to integrate continuous testing and continuous deployment without compromising on code quality.

Powered by AI, QA testing can now be performed 24×7. It need not wait until a product or a part of it is fully developed. Re-tests required in accordance with the changes made to the UI or in the backend can become a seamless process. With our scriptless testing consulting, each time a new code is pushed, running the required test to see its impact on the functionality is fast and easy.

Sun Technologies has emerged as a pioneer in Scriptless Automation Tool deployment for leading insurance industry tech teams. By empowering them with advanced testing techniques we are speeding up the delivery of application and database modernization while improving their return on Investment from automation initiatives.

Looking for DevOps velocity to deal with a rapidly evolving insurance landscape?

Get the right Scriptless Automation tools and frameworks matching your Insurance SLDC and Insurance App Testing efficiency needs.